Let's get creative!

Unlock your potential with tools, templates & courses to kickstart your creativity

-

Courses

CoursesInvest in your future with a variety of courses & ebooks that promise both personal and professional growth.

-

Templates

TemplatesBrowse a diverse range of templates, from planners to graphics, designed to streamline your workflow and elevate your projects.

-

Resources

ResourcesUnlock an array of resources, from curated videos to trusted websites and essential tools, tailored to supercharge your creative journey.

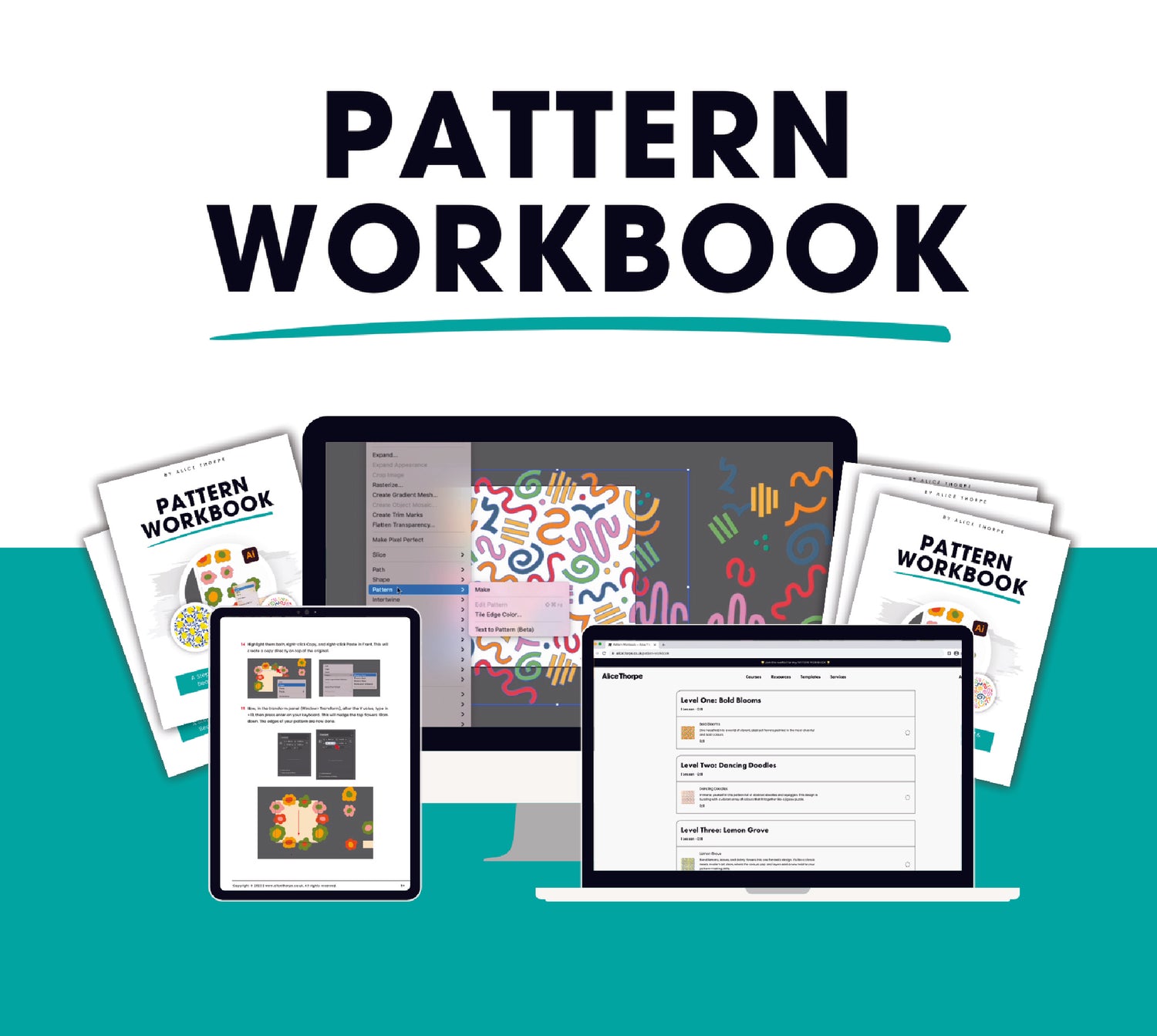

Want to learn how to create patterns?

This workbook is your ticket to mastering the art of seamless pattern design using Adobe Illustrator.

-

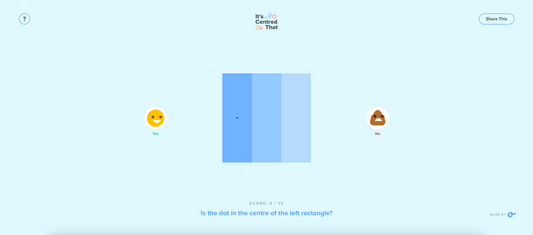

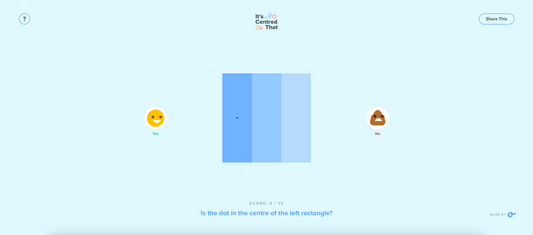

5 Best Games for Graphic Designer Beginners

Enhance Your Graphic Design Skills: 5 Engaging Games for Beginners Are you a budding graphic designer eager to level up your skills? Well, look no further! Let me tell you...

5 Best Games for Graphic Designer Beginners

Enhance Your Graphic Design Skills: 5 Engaging Games for Beginners Are you a budding graphic designer eager to level up your skills? Well, look no further! Let me tell you...

-

My ✨NEW✨ Podcast: Creativity Unfiltered

Candid conversations, authentic insights, and a whole lot of creative magic; this is Creativity Unfiltered.

My ✨NEW✨ Podcast: Creativity Unfiltered

Candid conversations, authentic insights, and a whole lot of creative magic; this is Creativity Unfiltered.